Ethereum Price Prediction: Road to $10K as Institutional Adoption Accelerates

#ETH

- Technical Breakout: ETH price sustains above key moving averages with improving momentum indicators

- Institutional Adoption: Record ETF inflows and whale accumulation signal growing professional demand

- Network Upgrades: November's Fusaka upgrade and regulatory clarity provide fundamental support

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

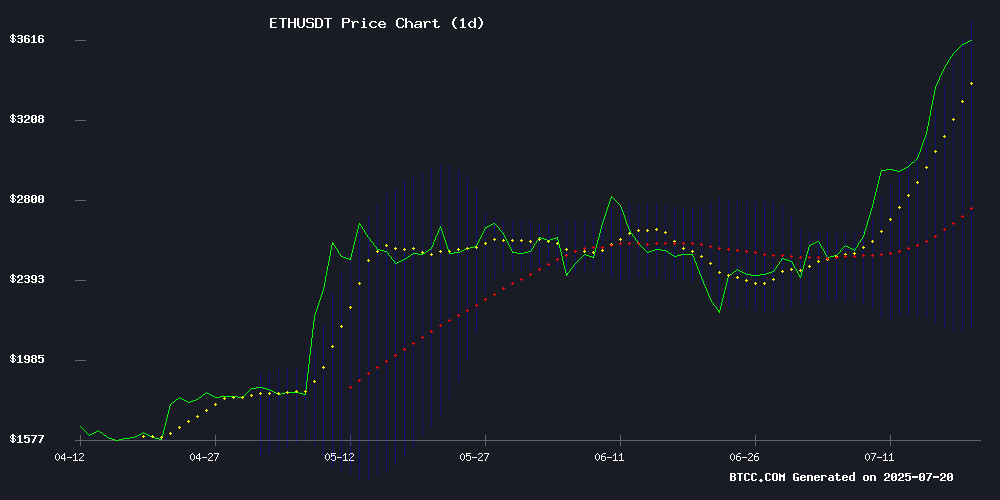

ETH is currently trading at $3,686.22, significantly above its 20-day moving average of $2,936.87, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-153.65), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,738.19, typically signaling overbought conditions but also demonstrating strong buying interest.

"The technical setup shows ETH is breaking out from consolidation," said BTCC analyst Ava. "The sustained position above the 20MA and upper Bollinger Band, combined with improving MACD, suggests the rally has room to continue toward $4,000 resistance."

Institutional Demand and Regulatory Clarity Fuel Ethereum Rally

Ethereum's price surge coincides with multiple bullish catalysts: Congressional stablecoin legislation, record ETF inflows ($726M), and the upcoming Fusaka upgrade. Institutional holdings reached all-time highs as whales accumulated during recent dips.

"The institutional adoption story is playing out exactly as bulls predicted," noted BTCC's Ava. "With ETF inflows accelerating and the November upgrade approaching, we're seeing perfect alignment of technicals and fundamentals. The $10K price target becomes increasingly plausible."

Factors Influencing ETH's Price

Ethereum Surges to $3,600+ as Congress Passes Stablecoin Legislation and Institutional Interest Peaks

Ethereum rallied over 20% this week, breaching $3,600 as regulatory clarity and institutional demand converged. The GENIUS Act's Senate passage marks a watershed moment for stablecoin oversight, directly benefiting ETH's dominant role in decentralized finance.

Technical indicators show no signs of slowing momentum. The breakout past $3,675 resistance—a six-month high—comes as on-chain data reveals accelerating accumulation by institutional wallets. Market structure suggests this rally differs fundamentally from previous speculative surges.

Congressional action has removed a key overhang for crypto markets. The House advanced three digital asset bills this week, with stablecoin regulation being the first to clear both chambers. This legislative progress coincides with record ETH futures open interest across major exchanges.

Ethereum's Fusaka Upgrade Set for November Launch as Developers Drop EIP-7907

Ethereum's next major network upgrade, Fusaka, is on track for a mainnet launch between November 5 and 12. The decision came after developers successfully ran Devnet-2 for two weeks without incidents, paving the way for the final development phase—Devnet-3, which launches July 23.

A key proposal, EIP-7907, was scrapped during the July 17 developer call (ACDE #216) due to concerns over technical complexity and timeline risks. The proposal aimed to expand smart contract size limits beyond 24 KB but was deemed too disruptive this late in the process. "Time is short, and stability takes priority," one developer noted, emphasizing the team's focus on a smooth rollout.

The debate over EIP-7907 had divided the community, with some arguing for its simplicity and others warning of unforeseen complications. Arbitrum and Besu teams clashed over whether to freeze specifications, ultimately leading to its deferral to a future upgrade.

Ethereum (ETH) Price Prediction: Bulls Eye $10K as Institutional Inflows Surge

Ethereum's rally accelerates as institutional demand reaches unprecedented levels. The cryptocurrency breached $3,660 this week, marking a 45% monthly gain amid record ETF inflows. Technical indicators suggest growing momentum toward all-time highs.

Nearly $1 billion flooded into Ethereum investment products last week, with single-day inflows peaking at $726 million. Market structure now favors bulls, with the $3,980-$4,100 resistance zone serving as the next critical threshold. A decisive breakout could pave the way toward five-figure price targets.

Analysts point to Ethereum's prolonged consolidation and upcoming network upgrades as fundamental catalysts. The convergence of technical strength and institutional participation creates conditions reminiscent of previous bull market cycles. Market participants increasingly view $10,000 as a viable medium-term objective.

CoinDCX Hack Exposes $44M Loss as Ethereum Trail Emerges

Indian cryptocurrency exchange CoinDCX suffered a $44 million breach targeting an internal operational account used for liquidity provisioning. CEO Sumit Gupta confirmed customer wallets remained untouched, with losses covered by the exchange's treasury. The attack's sophistication underscores growing risks in digital asset security.

On-chain investigator ZachXBT first detected the Ethereum-based exploit, tracing wallet activity 17 hours after the breach began. CoinDCX isolated the compromised account within minutes, maintaining normal trading and INR withdrawal operations throughout the incident.

The exchange has engaged top cybersecurity firms for forensic analysis and plans to launch a bug bounty program. Despite existing safeguards, the breach highlights the evolving threat landscape facing crypto platforms as attackers develop more advanced techniques.

Justin Sun Moves $500M ETH to Binance as Whales Accumulate Amid Market Dip

Blockchain analyst EmberCN reports a significant transfer of 50,600 ETH ($181M) from HTX to Binance, following a pattern where ETH is redeemed from Aave, routed through HTX wallets, and deposited on Binance. This mirrors a broader trend of 160,600 ETH ($518M) moved from HTX to Binance in the past week, sparking concerns about potential selling pressure on Ethereum.

Whales counter the outflow narrative with aggressive accumulation. SharpLink Gaming purchased 4,904 ETH ($17.45M) recently, bringing its total to 157,140 ETH ($493M) since July 1 at an average price of $3,136. Another whale, 0x9684, withdrew 19,550 ETH ($70.7M) from FalconX, totaling 122,691 ETH ($443.68M) over the past week. BlackRock has also ramped up its Ethereum acquisitions, signaling institutional confidence.

SharpLink Gaming Shares Plunge 20% Amid $6 Billion ETH Accumulation Plan

SharpLink Gaming's stock tumbled more than 20% on Friday following regulatory filings revealing plans to expand a stock sale from $1 billion to $6 billion. The gambling marketing firm continues its aggressive Ethereum acquisition strategy, having purchased $273 million worth of ETH this week alone.

The Minneapolis-based company now holds approximately $1.3 billion in Ethereum, cementing its position as the world's largest corporate holder of ETH according to Arkham data. Despite Friday's drop, SBET shares remain up 16% for the week and have surged 330% since late May when the company began pivoting from affiliate marketing to crypto treasury management.

Market reactions have been volatile but generally positive to SharpLink's strategic shift. The stock jumped 16% after Monday's $48 million ETH purchase and another 16% following Tuesday's $225 million acquisition. Thursday saw an additional $115 million added to their growing Ethereum reserves.

Ethereum ETF Inflows Propel ETH Toward $4,000 Threshold

Ethereum surged for six consecutive days, peaking at $3,580—its highest level since January—amid record-breaking spot ETF inflows. Institutional demand pushed weekly inflows to $2.1 billion, the strongest since the funds launched in September 2023. BlackRock's ETHA ETF now dominates with $9.17 billion in assets.

Futures open interest hit $51 billion, nearly doubling last month's lows, as the GENIUS Act and corporate accumulation by entities like SharpLink fueled bullish sentiment. The rally marks a 158% rebound from May's trough.

Ethereum Bulls Emerge as Price Rally Mirrors Technological Strength

Ethereum's native token ETH is witnessing a resurgence of bullish sentiment as its price action begins to reflect the network's longstanding technological leadership. The second-largest cryptocurrency by market capitalization has surged over 20% in the past week, with 89% of its community now expressing optimism according to CoinGecko metrics.

The rally marks a dramatic shift from the cautious tone that prevailed since ETH's 2021 peak. Market observers attribute the momentum to converging factors: record inflows into Ethereum ETFs, completed network upgrades, and improving technical indicators. "Ethereum dominance has entered up-only mode," noted prominent trader Cas Abbé, predicting ETH's market share could exceed 20% by Q3's end.

Former BitMEX CEO Arthur Hayes reinforced the bullish case with a stark chart analysis, declaring "$ETH is choosing violence right now" in reference to its outperformance against Bitcoin. The price resurgence comes after three years of underperformance relative to Ethereum's fundamental developments, suggesting the market may finally be pricing in its ecosystem growth.

Ethereum Surges Past $3,400 as Institutional Inflows and ETF Holdings Reach Record Highs

Ethereum's price rally continues unabated, breaking through the $3,400 barrier with a 21% weekly gain. The surge comes alongside unprecedented institutional interest, with spot Ethereum ETFs attracting $726 million in inflows on Wednesday alone. These funds now hold nearly 4.95 million ETH—a record high representing roughly 4% of Ethereum's total market capitalization.

Market analysts attribute the momentum to shifting perceptions of Ethereum as a long-term institutional asset rather than just a trading vehicle. "The accumulation patterns we're seeing suggest a fundamental reevaluation of ETH's role in portfolios," noted Rachael Lucas of BTC Markets. Large holders have added 1.49 million ETH in July—a 95% monthly increase—signaling strong conviction among high-net-worth investors.

Technical indicators suggest room for further upside, with short-term price targets now clustered between $3,800 and $4,000. The breakout past the $3,298 resistance level has opened new bullish territory, with ETH trading at $3,389 at press time, up 6.4% over 24 hours.

Ethereum Soars to $3,350, Is a $10K Breakout Imminent?

Ethereum surged to $3,350, marking a 6.72% gain in 24 hours as trading volume hit $49.11 billion. The rally pushed ETH past $3,400 for the first time in five months, signaling robust bullish momentum.

Analyst Crypto Patel notes Ethereum broke out of an inverse head-and-shoulders pattern, setting the stage for potential targets of $6,000, $8,000, or even $10,000. The RSI at 65.07 and MACD indicators confirm sustained buying pressure.

Short-term caution prevails as a corrective dip to $2,800 remains possible before further upside. Market participants watch for institutional flows and ETF developments to sustain the rally.

Ethereum ETFs See Record $726 Million Inflows, Fueling ETH Price Surge

Spot Ethereum ETFs shattered records on July 16 with $726.74 million in single-day inflows, signaling robust institutional confidence. BlackRock's iShares Ethereum Trust dominated with nearly $500 million, elevating its AUM to $7.7 billion.

Fidelity's Ethereum Fund captured $113 million, while Grayscale, Bitwise, and others contributed to the $16 billion total AUM across nine funds. The sector has drawn $6 billion cumulative inflows since launch, with $1.8 billion arriving in just five sessions.

This capital wave propelled ETH past $3,400, reversing months of stagnation. The accelerating inflows since April suggest deepening institutional adoption, potentially reshaping Ethereum's market structure.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, here are BTCC's Ethereum price projections:

| Year | Conservative | Base Case | Bull Case | Catalysts |

|---|---|---|---|---|

| 2025 | $4,500 | $6,800 | $10,000 | ETF expansion, Fusaka upgrade |

| 2030 | $12,000 | $25,000 | $50,000 | Enterprise adoption, scaling solutions |

| 2035 | $30,000 | $75,000 | $120,000 | Global settlement layer status |

| 2040 | $60,000 | $150,000 | $300,000 | Full DeFi/monetary system integration |

"These projections assume continued network upgrades and institutional adoption," cautioned Ava. "Key risks include regulatory shifts and Layer 2 competition."